What Helps Make a Great Retirement Plan?

At its core, a great retirement plan helps employees create successful retirement outcomes. Retirement plan greatness also means continually striving to make the plan easy to manage, compliant, and cost effective for our clients.

Are you ready to start building a great retirement plan together?

What Helps Make a Great Retirement Plan?

Partner with an advisor who understands your needs and is easy to work with

We know you’re busy wearing many different hats during an average workday. That’s why we made partnering with OnTrack401(k) as simple and easy as possible. Our primary focus is to thoroughly understand your plan’s unique needs.

OUR 5-STEP SERVICE ROADMAP

1

INITIAL DISCOVERY

Discovery is as easy as providing OnTrack 401(k) with your fee disclosures and current service agreements. We will help you find plan and participant fee disclosures as well as any service agreements in place.

2

ANALYZE

Our in depth analysis will show you all of the fees associated with your retirement plan and how your fees stack up to other plans your size. We will:

• Analyze your current investments and recommend changes if needed.

• Evaluate your fiduciary liability and provide recommendations to help reduce your exposure.

• Analyze your plan utilization and provide proactive plan design recommendations.

3

STRATEGIZE

Our analysis and recommendations will bring clarity to your retirement plan and help you make informed decisions so that your retirement plan matches your company objectives. We will develop a plan to make improvements in the most cost effective and efficient way.

4

IMPLEMENT

If changes are needed, OnTrack 401(k) will manage the process to make it as easy as possible for you.

5

MONITOR & DOCUMENT

OnTrack 401(k) can serve your plan as an ERISA 3(21) or 3(38) fiduciary. We will:

• Monitor and benchmark the fees and investments in your retirement plan.

• Document the prudent process we use to monitor your plan.

• Report to the investment committee.

• Track progress of plan utilization to ensure employees are getting the most out of your plan.

In many cases, we can make a few initial recommendations that will immediately improve plan performance without necessitating a change in recordkeeper — providing minimal disruption to you and your employees.

What Helps Make a Great Retirement Plan?

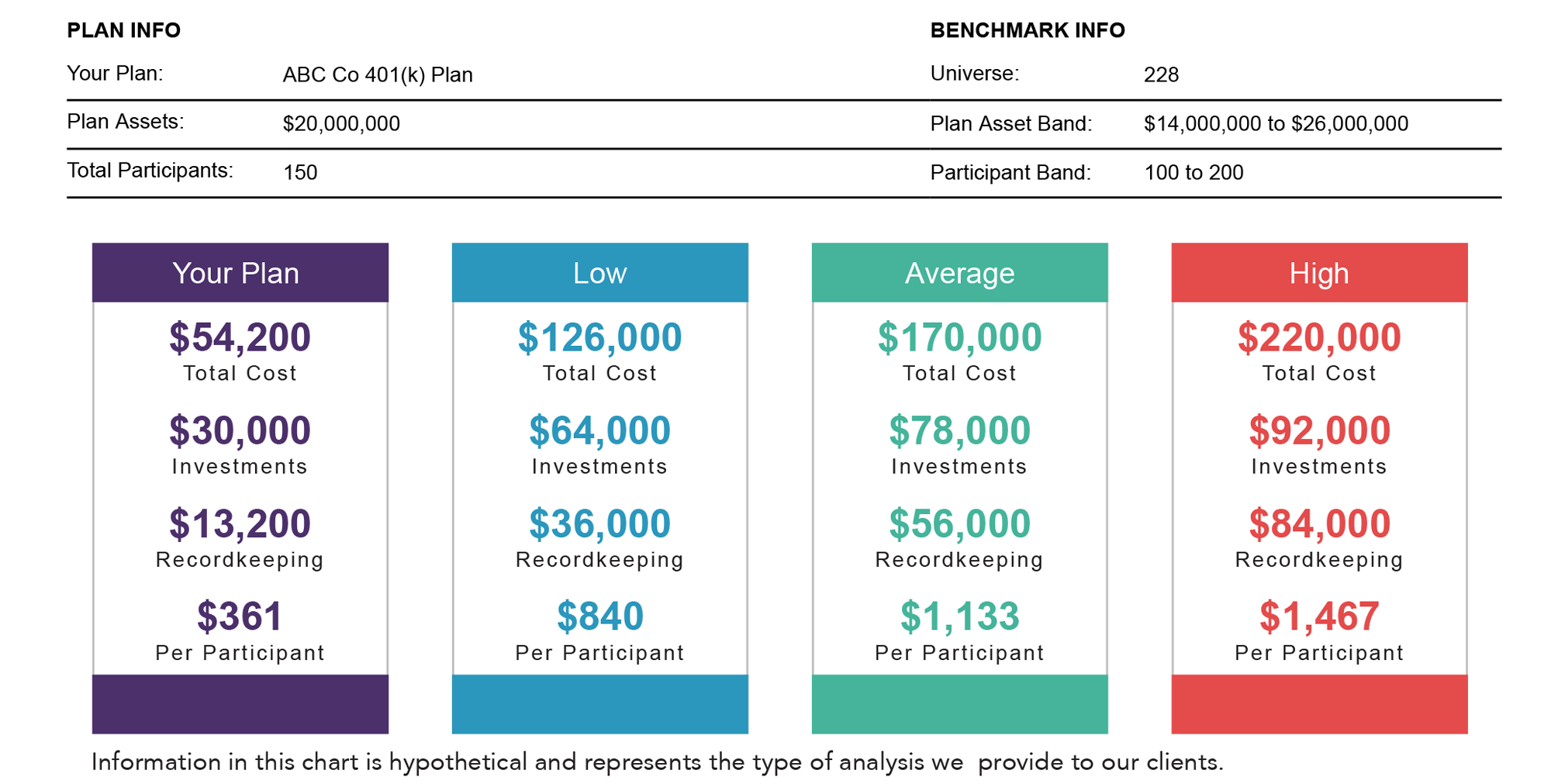

Clearly understand what services you are paying for and how much.

OnTrack 401(k) is committed to helping you understand your plan’s current costs and fees in a format that is easy to digest and understand. Going forward, we work to help ensure your plan’s cost is always truly reflective of the services and value that you and your employees need.

FEE BENCHMARKING ANALYSIS

What Helps Make a Great Retirement Plan?

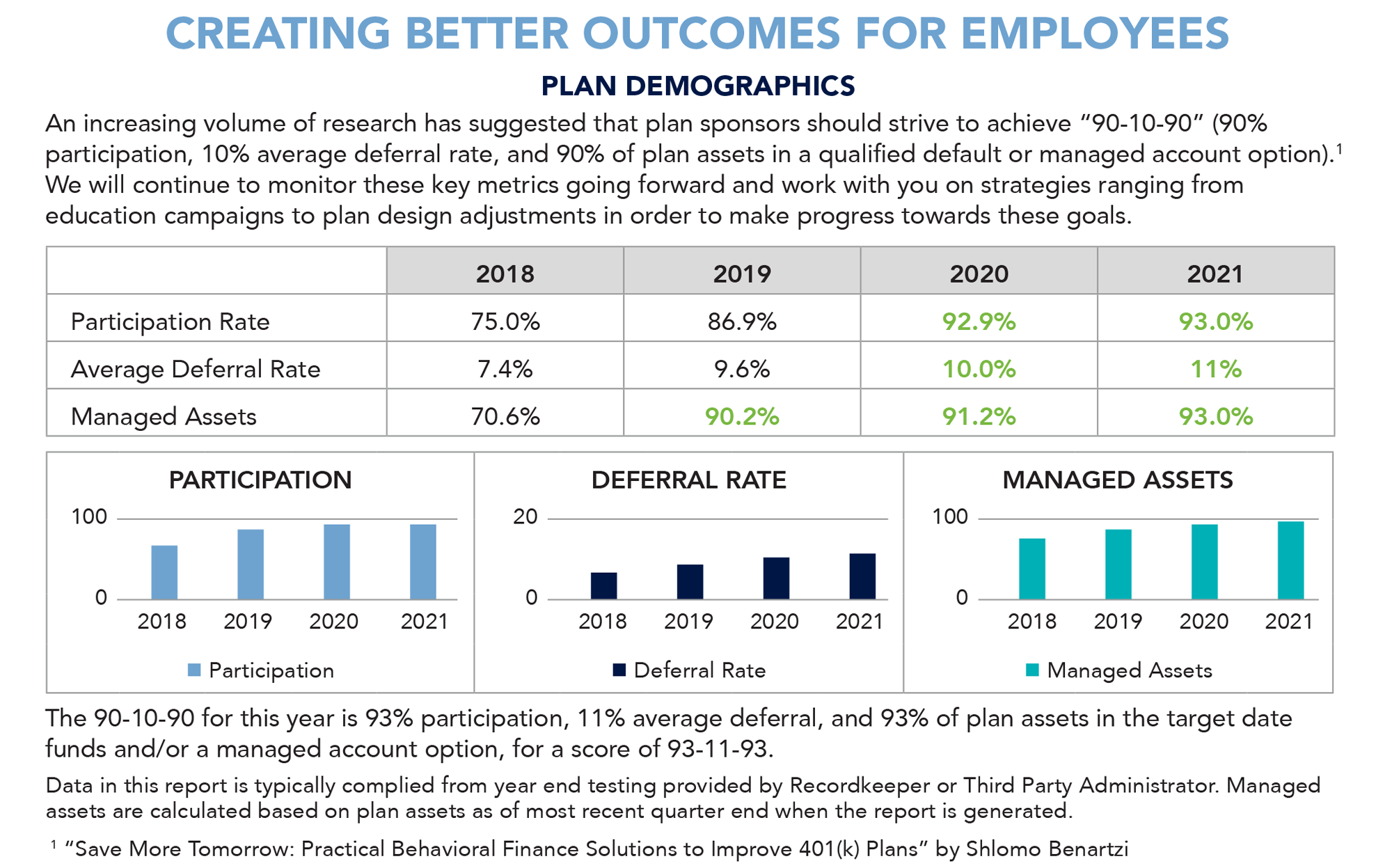

Embrace plan reporting and data; rely on it to measure plan success and identify areas that need improvement.

OnTrack’s Plan Review is our “report card”. While it covers many details and aspects of your retirement plan, its essential purpose is to present you with a way to track your plan’s progress toward greatness.

A key component of OnTrack 401(k)’s formal Plan Reviews is measuring employee engagement with the plan. Are we making progress in helping your employees achieve better outcomes?

What Helps Make a Great Retirement Plan?

Leverage a financial wellness program that delivers practical answers to the questions and challenges your employees have right now.

- I’m drowning in credit card debt. How do I pay it off?

- I want to plan ahead for my kids’ college education.

Where do I start? - It feels like I’ll have student loans forever. Can you help me make a payoff plan?

- Should I purchase term or whole life insurance?

- Is a retirement plan loan a bad idea? Are there better

alternatives? - Can you help me decide if I am ready to buy a house?

- I need help navigating through this financial crisis. Can you help?

By providing answers to questions like these, Your Money Line helps your employees find the right balance with regard to achieving all their financial goals, including retirement.

What Helps Make a Great Retirement Plan?

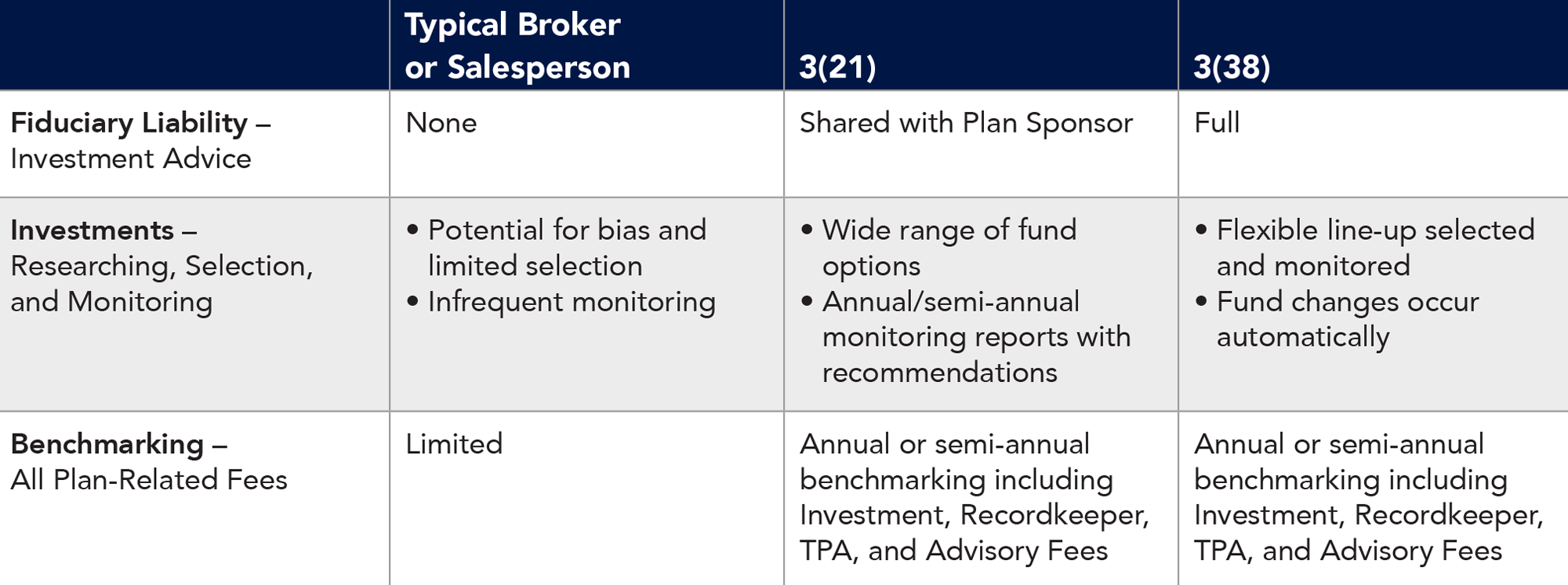

Lean on your advisor to help reduce

the fiduciary liability you face with regard to selecting, monitoring and managing plan investments.

As a 3(21) or 3(38) fiduciary, we help plan sponsors by taking on the heavy lifting of researching, selecting, monitoring and—as necessary—adding or replacing funds in your plan’s line-up. Below is an overview of the key differences between a non-fiduciary broker or salesperson versus our 3(21) and 3(38) service models:

As fiduciaries, we are contractually and legally obligated to serve in the best interest of our clients, with no conflicts of interest.

What Helps Make a Great Retirement Plan?

Trust your advisor to create an investment line-up that checks all the boxes, keeps you compliant, and empowers your employees to make good choices.

When it comes to selecting your plan’s investment line-up, OnTrack 401(k) adheres to the old adage less is more.

Your employees:

Won’t be overwhelmed by the number of available investment options

Will have access to low- cost, institutional share class investment options that represent the essential asset classes needed to meet ERISA 404(c) requirements.

Can take advantage of investment options that make the selection process simpler and easier (such as target-date funds or other Qualified Default Investment Alternatives).